|| शनिवार संवाद || 28-06-2025

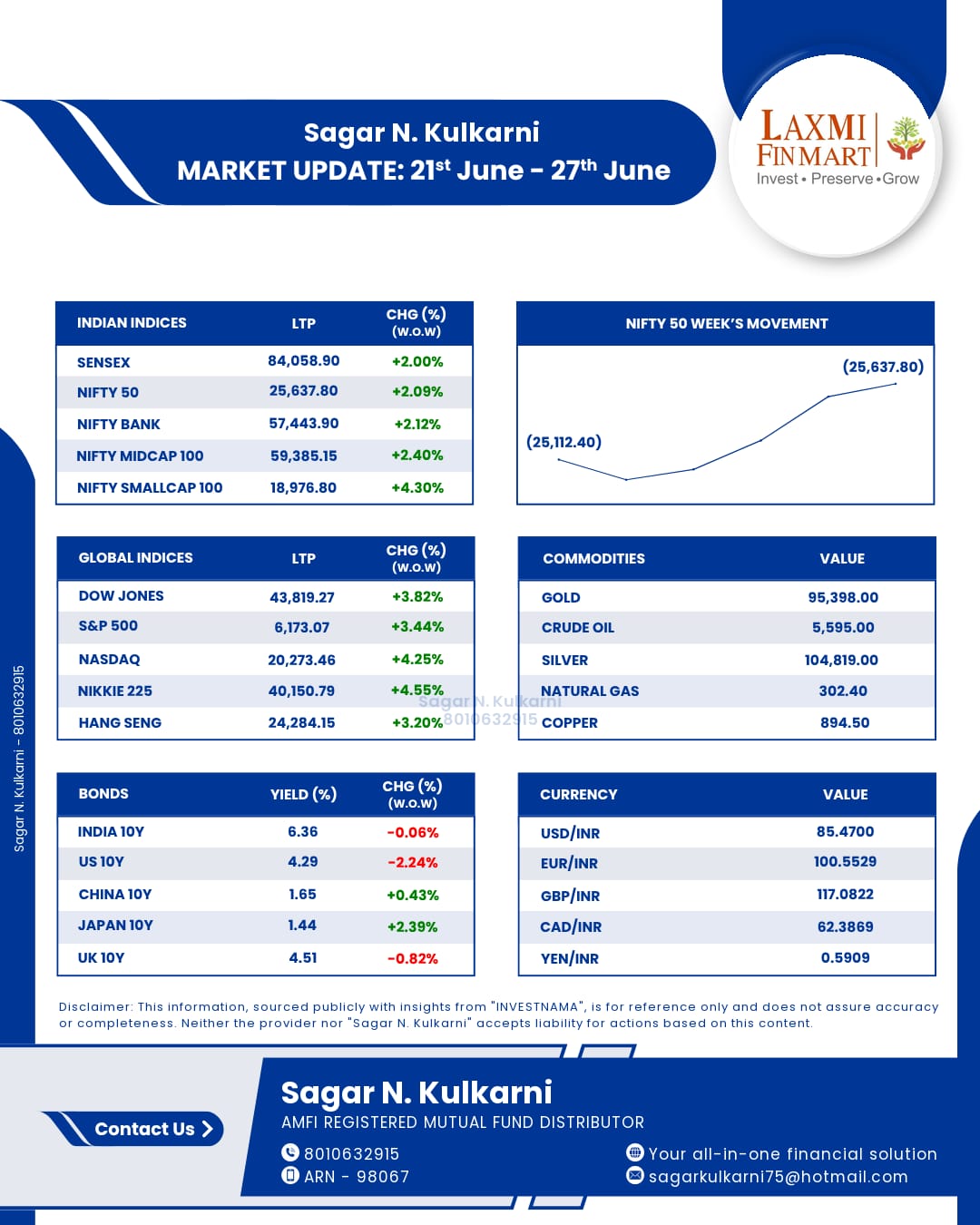

📊 Market Update: - 🇮🇳 Indian Market: This week, stock markets rallied 📈 with major indices nearing or crossing record highs, supported by a ceasefire between Israel and Iran that eased global tensions. Meanwhile, the Indian Rupee posted its best week since Jan 2023, ending below 85.5/$ 💵, helped by falling oil prices. This drop benefits oil-importing countries like India through lower import costs and improved margins for oil marketing companies. - 🌍 Global Market: After a slow performance in recent weeks, major stock indexes showed improvement. Fresh U.S. economic data pointed to a strong recovery, with GDP growth for the second quarter expected to exceed 3%, mainly because of steady consumer spending 📊. At the same time, the U.S. dollar index slipped to a three-year low 💵, making the currency weaker in global markets. Gold prices also dropped sharply ✨, reflecting reduced demand as geopolitical tensions eased and market uncertainty declined.